Maximize Your Monetary Versatility With Rapid Authorization Online Loans

In a world where monetary security is paramount, the capacity to promptly navigate unanticipated expenditures or take advantage of chances can make a substantial distinction. personal loans calgary. Rapid authorization on the internet fundings have arised as a strategic tool for individuals seeking to maximize their economic flexibility. By flawlessly blending innovation with economic services, these fundings provide a streamlined strategy to accessing funds in a timely manner. The advantages extend past simple convenience. As we dig right into the world of rapid authorization online finances, we uncover a globe where speed meets fiscal prudence, empowering individuals to take control of their monetary destinies.

Benefits of Rapid Approval Online Loans

When looking for monetary support, selecting fast approval on the internet car loans can provide individuals with swift access to much-needed funds. One of the key advantages of fast authorization online car loans is the comfort they offer. With simply a couple of clicks, borrowers can finish the application process from the comfort of their own homes, removing the demand to go to a physical bank or financial establishment. Furthermore, quick authorization on-line financings typically have marginal documents demands, making the application process fast and hassle-free.

Another advantage of quick approval on-line loans is the rate at which funds can be paid out. In most cases, borrowers can obtain approval within hours, allowing them to address immediate financial needs quickly. This quick accessibility to funds can be particularly beneficial in emergency situations or when unanticipated costs emerge.

Furthermore, quick approval on the internet loans might offer much more affordable rate of interest and terms contrasted to standard lending choices. By going shopping about and contrasting different online loan providers, customers can find a financing that fits their monetary scenario and needs. On the whole, rapid approval on-line car loans provide a hassle-free, reliable, and adaptable means to gain access to funds when required.

Exactly How to Request Online Loans

To initiate the process of applying for online loans, people can start by picking a trustworthy online lending institution that aligns with their economic requirements and choices. Looking into various loan providers is necessary to discover one that provides competitive rates of interest, favorable payment terms, and a safe and secure online platform for financing applications. Once a suitable lender is chosen, the individual can visit their website to start the application process.

Normally, the on the internet finance application will certainly require individual information such as name, address, get in touch with details, employment condition, earnings details, and banking info. It is important to give exact information to quicken the authorization process. Some lenders may likewise need added paperwork to verify the supplied details.

After submitting the on-line application, the lending institution will examine the information provided and perform a credit rating check to assess the individual's creditworthiness. bad credit loans alberta. If accepted, the funds can be disbursed rapidly, in some cases within the same day. It is very important to evaluate the finance terms carefully before approving the offer to make sure full understanding of the repayment obligations

Speedy Approval Refine Described

Discovering the quick evaluation methods utilized by online lending institutions drops light on great post to read the prompt approval process for loans. On-line lenders leverage advanced formulas and technology to enhance the finance application evaluation procedure, enabling quick choices on finance approvals. One essential factor adding to the quick authorization procedure is the automated verification of applicant information. By digitally validating information such as revenue, employment status, and banking info, on-line lending institutions can quickly evaluate a person's creditworthiness and make informed financing decisions in an issue of minutes.

In addition, on the internet loan providers commonly have marginal documents needs contrasted to standard banks, better quickening the authorization procedure. Applicants can easily post needed papers online, getting rid of the need for in-person sees or extensive documentation submissions. Additionally, the capacity to submit finance applications 24/7 suggests that consumers can receive authorization within hours, providing unrivaled speed and comfort in accessing much-needed funds. By prioritizing performance and development, on-line loan providers are revolutionizing the financing landscape, using debtors a seamless and fast borrowing experience.

Tips for Handling Funding Payments

Effective management of funding payments is necessary for preserving monetary security and growing a positive credit account. To effectively take care of loan settlements, beginning by developing a spending plan that includes your monthly repayment commitments.

In addition, take into consideration making extra settlements when feasible to decrease the total rate of interest paid and shorten the repayment period. By remaining arranged, connecting honestly, and making calculated economic decisions, you can effectively handle your loan payments and preserve your economic well-being.

Financial Versatility Techniques

Preserving economic adaptability requires calculated preparation and a positive approach to financial monitoring. Another critical element of economic flexibility is developing an emergency fund to cover unanticipated expenditures without derailing your long-lasting economic goals. In addition, consistently evaluating and adjusting your monetary strategy in reaction to adjustments in your revenue, costs, or economic objectives is essential for remaining adaptable and her latest blog durable in the face of unexpected situations.

Conclusion

It is crucial to understand the terms and conditions of the loan to make enlightened choices and preserve financial security. Making use of online loans can be an important tool in achieving economic objectives and attending to unforeseen expenses.

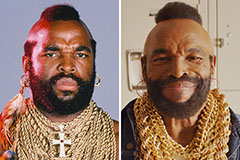

Mr. T Then & Now!

Mr. T Then & Now! Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Karyn Parsons Then & Now!

Karyn Parsons Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now!